IMS INCOME and IRAs

Contributory IRA accounts are available to all qualified investors. The minimum initial investment is $10,000 plus the establishment of an automatic monthly contribution.

The Suitability Guideline allows for the growth investments to decrease and the IMS Income investment to increase as the investor progresses to retirement.

Suitability Guideline A risk-control guideline for IRA investors

IRA Account Diversification

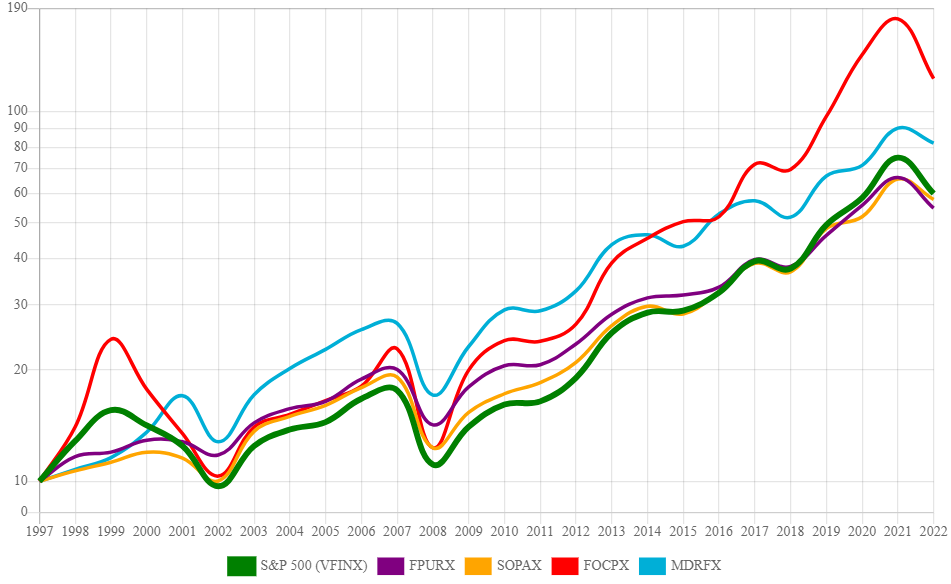

IMS Five-Funds Growth Program

IMS selects five no-load growth mutual funds that, together, are expected to perform close to that of the S&P 500 Stock Market Index over multiple market cycles. The five mutual funds in the portfolio are selected from among over 6,000 mutual funds and correlated to match the following funds and objectives.

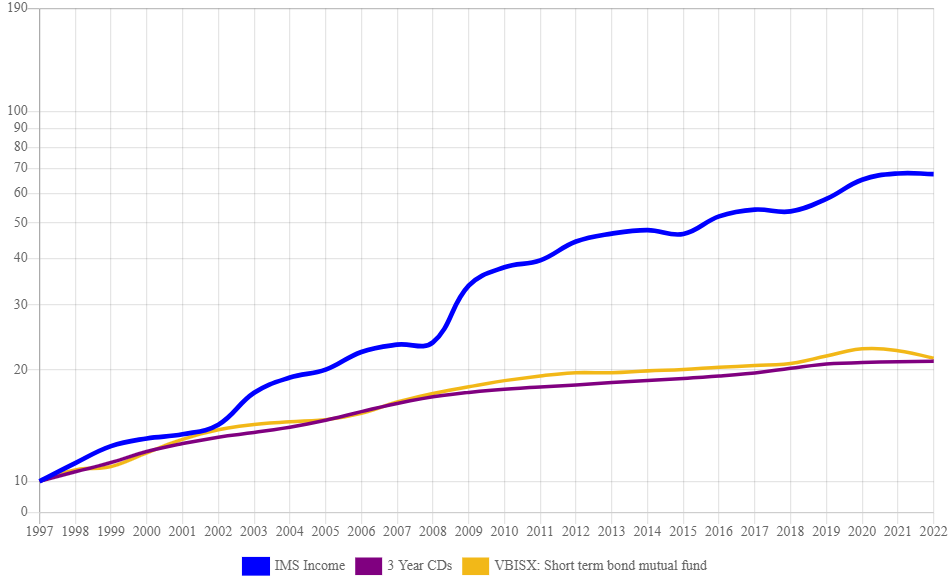

IMS Income

IRA investors are encouraged to follow the Suitability Guidelines to reduce risk as retirement approaches by increasing the portion invested in IMS Income.

IMS Five Funds Detail: IMS monitors the five equity mutual funds and makes a change only if necessary to maintain the integrity of their objectives. The five mutual funds are rebalanced each quarter to their relative percentages. The management fee associated with IMS Income is 1.2% per year, and the management fee associated with the less actively managed IMS Five Funds portfolio is 0.4% per year.

15% Nasdaq/OTC Fund Objective

40% The S&P 500 Stock Average

15% Mid-Cap Growth Objective

15% Dividend Growth Objective

15% Balanced Fund Objective

Suitability Guidelines

| IMS Five Funds | Age | IMS Income |

| 100% | 25-35 | 0% |

| 80% | 35-45 | 20% |

| 60% | 45-55 | 40% |

| 40% | 55-65 | 60% |

| 20% | 65-75 | 80% |

| 0% | 75+ | 100% |