IMS INCOME and CONSERVATIVE PORTFOLIOS

IMS Income qualifies as a conservative investment.

The minimum to establish an account is $100,000.

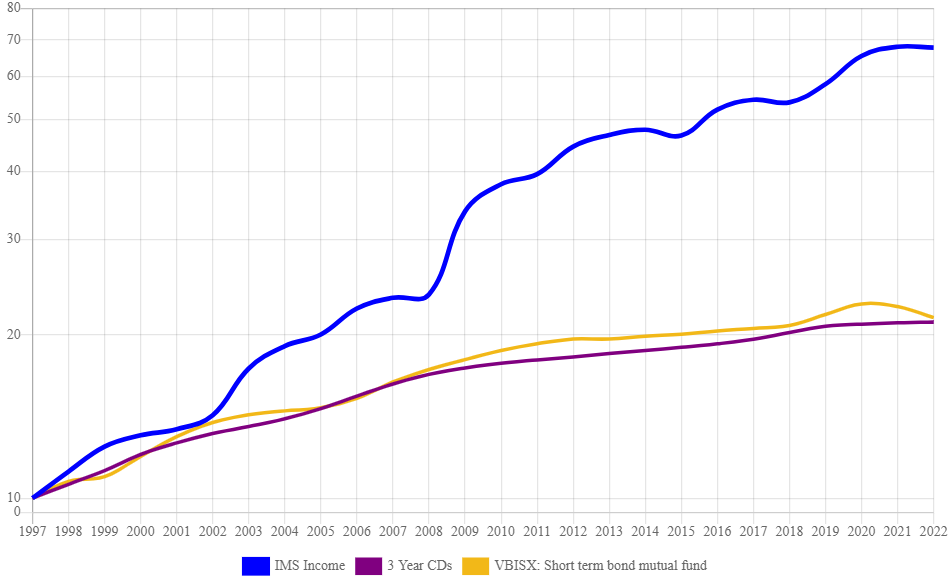

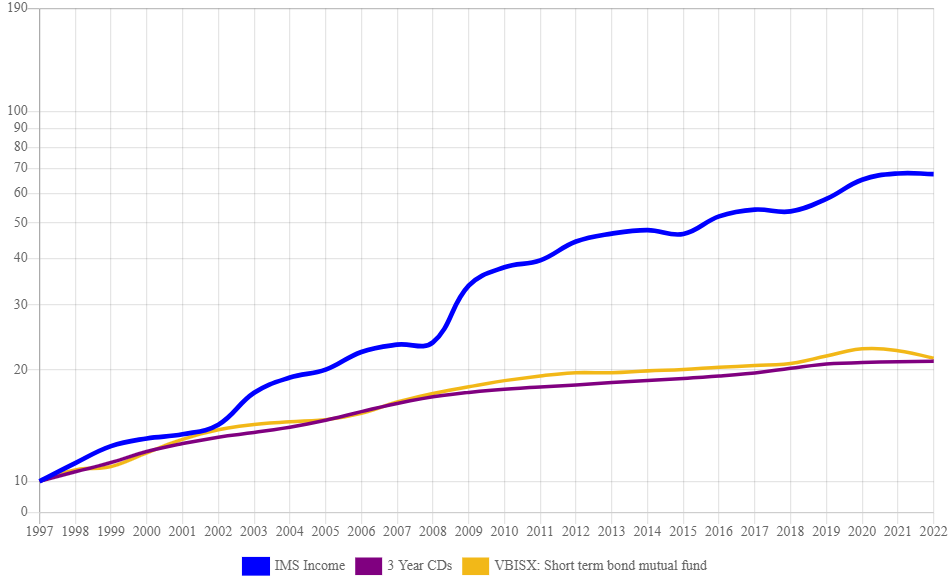

Comparisons

IMS Income has provided an upside dimension to conservative investing (the blue line) .

The level of volatility, or risk, is closer to that of the short-term bond market (the gold line) than it is to that of the stock market.

Diversified Accounts

IMS Income

The IMS Income program invests in several no-load high-yield mutual funds. IMS Income is expected to substantially reduce the risk of the high-yield bond funds by investing periodically in the money market.

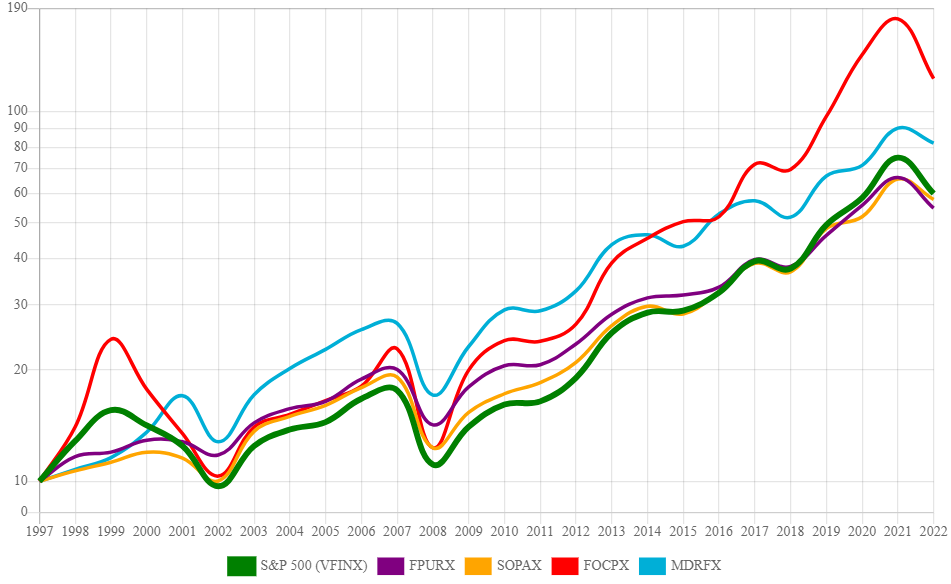

Conservative investors can diversify their portfolios by investing a percentage in five equity mutual funds.

IMS Five Funds

IMS selects five no-load growth mutual funds that, together, are expected to perform close to that of the S&P 500 Stock Market Index over multiple market cycles. The five mutual funds in the portfolio are selected from among over 6,000 mutual funds as detailed below.

IMS Five Funds Detail: IMS monitors the five equity mutual funds and makes a change only if necessary to maintain the integrity of their objectives. The five mutual funds are rebalanced each quarter to their relative percentages. The management fee associated with IMS Income is 1.2% per year, and the management fee associated with the less actively managed IMS Five Funds portfolio is 0.4% per year.

15% Nasdaq/OTC Fund Objective

40% The S&P 500 Stock Average

15% Mid-Cap Growth Objective

15% Dividend Growth Objective

15% Balanced Fund Objective

Custodial Account Options

One Investment Account

There are three pre-established combinations that require one Investment Account.

IMS Income 100% – IMS Five Funds 0%

IMS Income 80% – IMS Five Funds 20%

IMS Income 60% – IMS Five Funds 40%

Two Investment Accounts

The establishment of two Investment Accounts allows an unlimited number of combinations.

Examples:

IMS Income 88% – IMS Five Funds 12%

IMS Income 74% – IMS Five Funds 26%

IMS Income 53% – IMS Five Funds 47%

The owner can request an adjustment in the percentages by e-mail.

Bear Markets and Sleeping Well

IMS recommends you anticipate 50% bear market declines when determining the amount to invest in equity mutual funds. Begin by considering the decline you can accept for your total portfolio. Then review the following examples to help with your final decision.

Invest 10% in IMS Five Funds if you are comfortable with a temporary portfolio decline of 5%.

Invest 20% in IMS Five Funds if you are comfortable with a temporary portfolio decline of 10%.

Invest 30% in IMS Five Funds if you are comfortable with a temporary portfolio decline of 15%.