IMS offers two investment programs that cover the risk spectrum for most investors.

IMS Income is low risk and has occasional small declines. Recovery is measured in months. IMS Five Funds is market risk and has occasional large declines. Recovery is measured in years.

IMS clients control risk by how they allocate their assets. Allocation based on suitability is the key to successful wealth management.

IMS Income

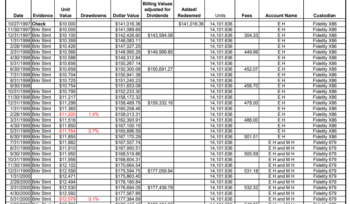

IMS Income has been invested in high-yield bond mutual funds or in the money market for over 25 years. The investment position is determined by a trend following algorithm developed during the summer of 1997. The IMS Income program is reviewed daily. The annual management fee is 1.2%.

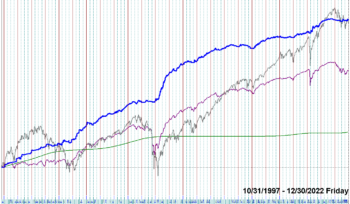

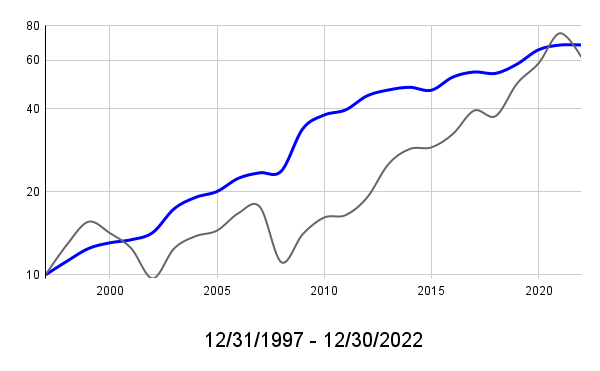

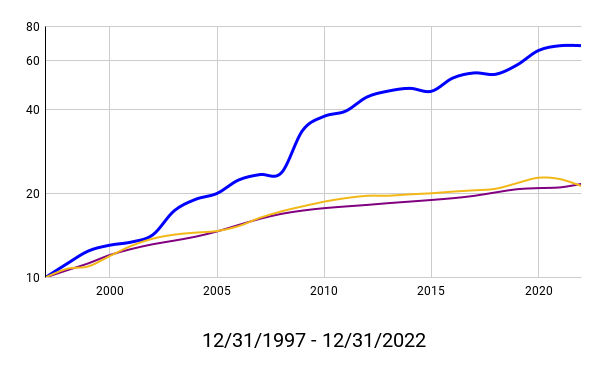

The chart is the initial IMS Income Account and the S&P 500 Stock Index (VFINX).

Total gains over the period are IMS Income +580%, S&P 500 Stock Index +553%.

The Short-Term Objective

The short-term objective of IMS Income is to outperform Short-Term Bonds and Jumbo Certificates of Deposit over all five-year periods:

| IMS Income (Initial Account) | 573.9% |

| Short Term Bonds VBISX | 112.9% |

| Certificates of Deposit (JCDI) | 116.8% |

The Long-Term Objective

The long-term objective of IMS Income is to keep pace with the S&P 500 Stock Index over several market cycles:

| IMS Income (Initial Account) | 573.9% |

| S&P 500 Stock Index (VFINX) | 513.6% |

| All High-Yield (FastTrack) | 238.4% |

| Money Market (FDRXX) | 57.3% |

IMS Income portfolio trades are made between the green Money Market line and several high-yield mutual funds selected from the purple All High-Yield line. The result is the blue IMS Income line.

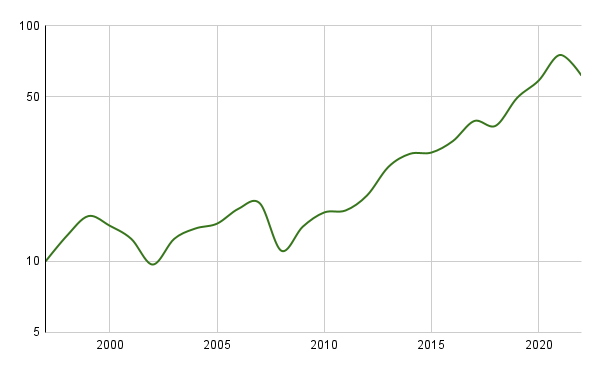

IMS Five Funds

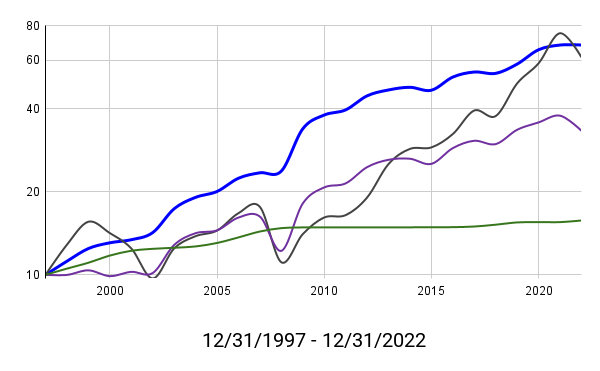

Mutual funds selected for the IMS Five Funds portfolio represent the broader stock market.

Forty percent of the portfolio is an S&P 500 Index fund. The remaining sixty percent is divided equally among four additional funds.

The IMS Five Funds portfolio is reiewed quarterly. The annual management fee is 0.4%.

The Mutual Funds

IMS Five Funds is a well diversified stock market program designed to complement the conservative IMS Income program.

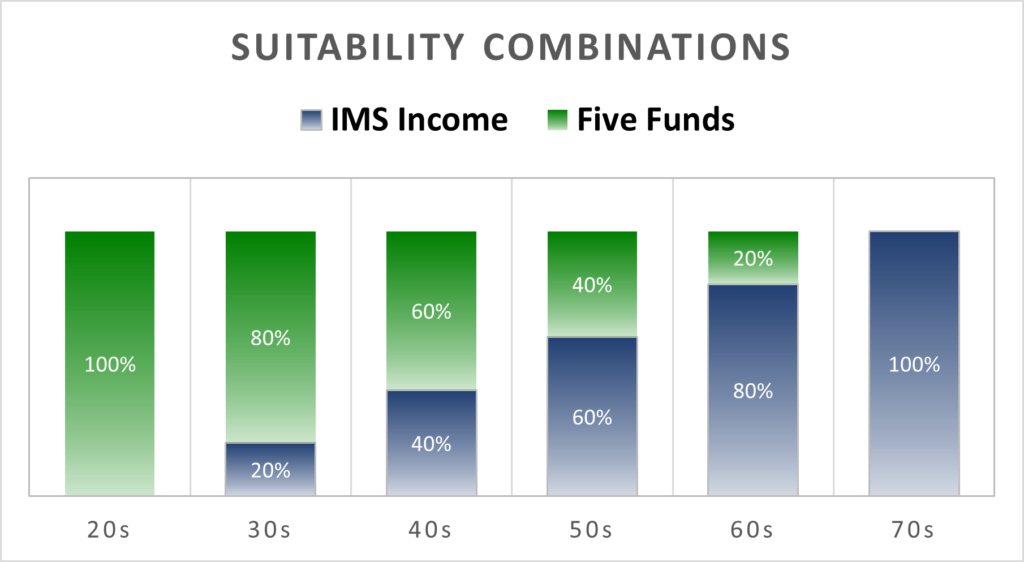

Suitable Combinations

We offer six investment options with IMS Income and IMS Five Funds. Suitability is the key. Clients are encouraged to select the combination for which an occasional IMS Five Funds decline of 50% or more is anticipated and accepted.

The six options are interchangeable once a year by e-mail request. They are held in a single Equity Trust Company (ETC) custodial account.

The management fee for the options range from 0.4% to 1.2%.

| 0% IMS Income | 100% IMS Five Funds | Man Fee 0.4% per year |

| 20% IMS Income | 80% IMS Five Funds | Man Fee 0.6% per year |

| 40% IMS Income | 60% IMS Five Funds | Man Fee 0.7% per year |

| 60% IMS Income | 40% IMS Five Funds | Man Fee 0.8% per year |

| 80% IMS Income | 20% IMS Five Funds | Man Fee 1.0% per year |

| 100% IMS Income | 0% IMS Five Funds | Man Fee 1.2% per year |

Build Your Wealth

The minimum investment is $10,000 plus automatic monthly additions, or $100,000 if no automatic additions.

IMS Five Funds is an opportunity to build wealth. The program is suitable for Traditional, Roth and Simple IRAs.

Our general recommendations are:

Age 25 to 35: 100% IMS Five Funds

Age 35 to 45: 80% IMS Five Funds / 20% IMS Income

Age 45 to 55: 60% IMS Five Funds / 40% IMS Income

Enjoy Your Wealth

The minimum investment is $100,000.

IMS Income is designed to reduce volatility by investing in high-yield mutual funds or defensively in the money market.

Our general recommendation is:

Age 55 to 65: 60% IMS Income / 40% IMS Five Funds

Age 65 to 75: 80% IMS Income / 20% IMS Five Funds

Age 75 plus: 100% IMS Income

Share Your Wealth

100% invested in IMS Income

The minimum investment is reduced to $50,000 in a separate IRA account.

IMS offers a reduced minimum of $50,000 to encourage financially secure seniors to support their charitable interests. We suggest a rollover to a separate IRA account invested in the IMS Income program.

The ON DEMAND feature provided by the custodian allows for monthly deposits to a qualified non-profit with one initial request. IMS anticipates the charitable donations will continue for multiple years to honor the reduced minimum.

Seniors in their 60s can donate systematic deposits to their selected non-profit prior to the onset of their Required Minimum Distributions (RMDs). These donations are not tax deductible for those who take the standard deduction unless made through a Donor Advised Fund (DAF).

Seniors in their 70s and 80s are encouraged to arrange the monthly donation of a portion of their RMDs to support the revenue base of their charitable interests.

Donations to non-profits that help to satisfy an RMD are excluded from taxable income. To qualify, donations must be paid directly from an IRA to the selected non-profits. These are Qualified Charitable Distributions (QCDs).