IMS INCOME

The IMS Income program invests in high-yield bond mutual funds or in the money market for defensive purposes.

The algorithms that change the investment positions are trend following in nature and have been consistently applied throughout the history of the program.

IMS Income

Account Unit Value

Aug 27, 2024 | $73.16

Investment Results

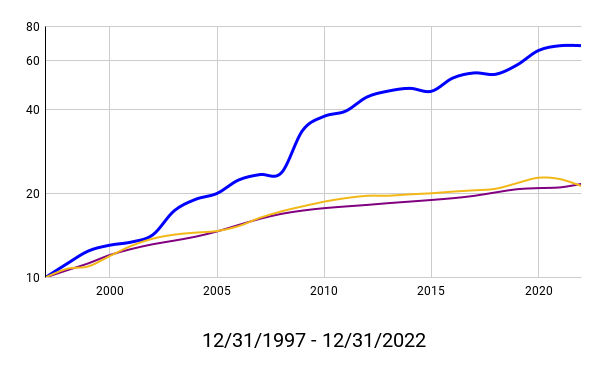

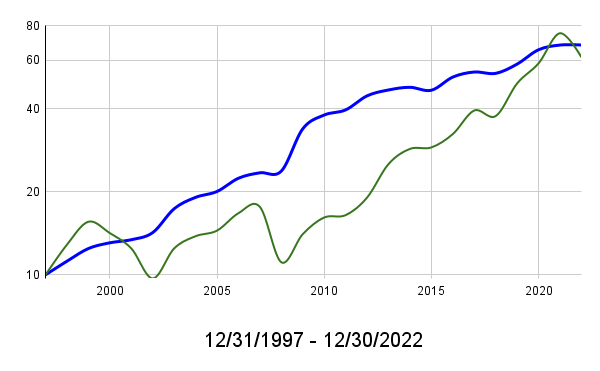

The following charts illustrate the IMS Income investment results from 1998 through June 2022 compared to short-term bonds, certificates of deposit and the S&P 500 Stock Market Index.

The short-term objective of IMS Income is to outperform Short-Term Bonds and Jumbo Certificates of Deposit over three-year periods (first chart).

The long-term objective of IMS Income is to keep pace with the S&P 500 Stock Market Index

over several stock market cycles (second chart).

1998 through 2022

♦ IMS Income Initial Account: 573.9%

♦ Short Term Bonds VBISX: 112.9%

♦ 3 Year Jumbo CDs JCDI: 116.8%

♦ IMS Income Initial Account 573.9%

♦ S&P Stock Index VFINX 513.6%

Gains and Risk

Average Annual Gains and Associated Risk from 1998 through 2022.

Investment

Type

IMS Income Initial Account

Vanguard 500 Index Fund (VFINX)

Vanguard Short-Term Bond Index Fund (VBISX)

JCDS Three-Year Jumbo Bond Index

Average Annual Gain

7.9%

7.5%

3.1%

3.2%

Associated

Risk

Low Risk

Substantial Risk

Low Risk

Minimal Risk

Ten Largest Calendar Year Gains

Five Largest Declines

Detailed Charts

Spokane

Seattle

Disclosures

Past performance is no guarantee of future results. It should not be assumed future performance will be profitable. Investments in equity mutual funds and high-yield bond mutual funds may result in a substantial loss of capital.